1921 to 1926 Gold Certificate Set Union of South Africa PMG Grades

|

|

|

FANTASTIC FRIDAY OFFER |

|

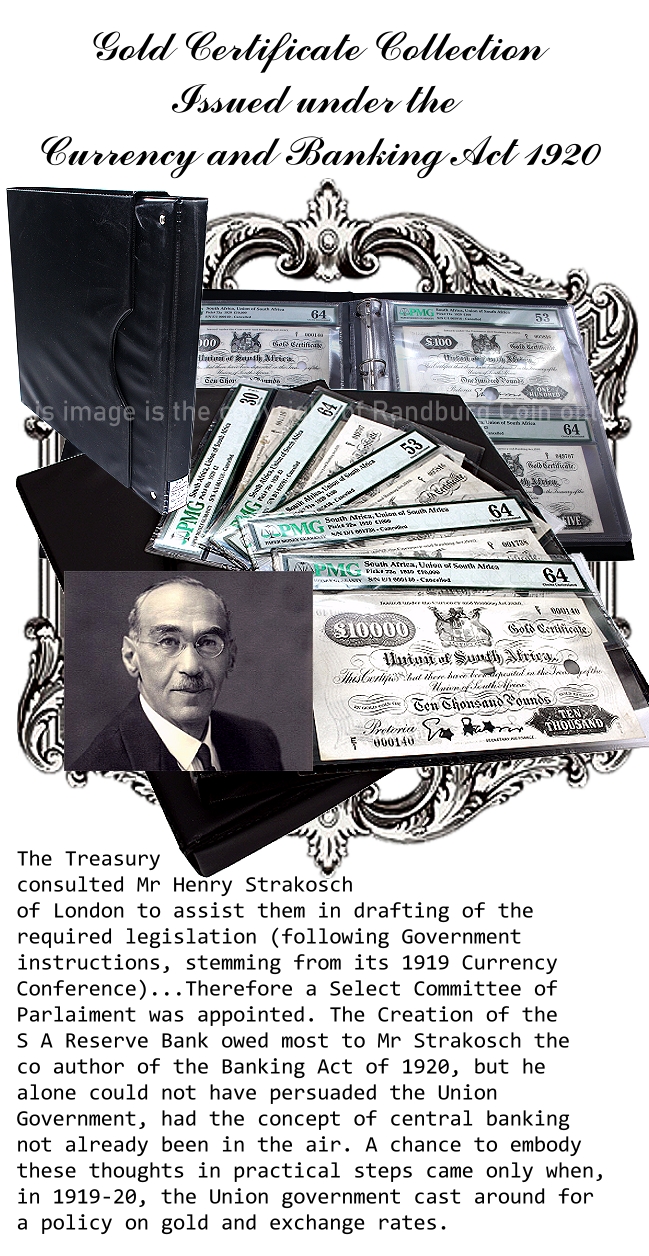

TAKE ADVANTAGE OF OUR !!! HISTORY IN YOUR HANDS !!! --------------------------------------------------------------------------------------------- CELEBRATING A SOUGHT-AFTER TREASURE OF NOTES A SIGNIFICANT AND HISTORIC SET OF SOUTH AFRICAN NOTES ISSUED AT THE TIME OF THE CREATION OF THE SOUTH AFRICAN RESERVE BANK GOLD CERTIFICATE COLLECTION PAPER MONEY GUARANTY (PMG) £1 GOLD CERTIFICATE - 30 VERY FINE PRICE FOR THIS PREMIUM COLLECTION RARELY OFFERED IN THE MARKETPLACE AN OUTSTANDING COLLECTION OF GOLD CERTIFICATES THAT WERE ISSUED BY THE TREASURY TO CONSERVE THE GOLD SPECIE SUPPLIES OF THE UNION BY PROVIDING FOR THE ISSUE OF GOLD CERTIFICATES INSTEAD, EQUAL TO THE GOLD VALUE OF THE

banknote images strictly copyright of Randburg Coin Don't miss this price opportunity ------------------------------------------------------------------------ Details: GOLD CERTIFICATES COLLECTION £1 GOLD CERTIFICATE - SIZE IN MM: 153 X 88 Description: A FASCINATING HISTORY OF THE ORIGINS OF THE SOUTH AFRICAN RESERVE BANK BORN OUT OF THE CURRENCY CONFERENCE OF 1920 The gold certificates scheme supported by Strakosch was perfectly suited to this purpose of representing the specie. This scheme involved the withdrawal of sovereigns from circulation, to be replaced by 'gold certificates in a one-for-one basis. The Certificates would be legal tender, but there would be no incentive to smuggle or hoard them, as they had no intrinsic value. They would be used as long as the premium existed. Moving the responsibility for the national currency from the government to the banks, the gold certificates completely eliminated the problems involved in maintaining the relation between private bank money and the national currency, by the simple expedient of changing the state-issued money. The problem for the private banks, so far as this relation was concerned, now was no longer to maintain a rate of exchange between the S.A.£. and the weight of gold in a sovereign, but merely to prevent inflation by avoiding overextension of credit. This understanding is reinforced by the argument made by Farrer, the Secretary for Finance, in his own testimony to the Select Committee, which endorsed Strakosch's views in every respect. Farrer pointed out that without a central bank, there is a limit to legitimate and desirable expansion of credit by the banks, as S.A. will have to look largely to itself in the future, it is almost essential to make a change in order to provide capital necessary to carry out the development of the country. Strakosch rejected the criticism that S.A.'s level of development was too low to justify a central bank, pointing instead to the boost which a reorganisation of the credit system could give to capital accumulation. The pre-war gold standard system had revolved around trade, so that the role of the Bank of England in credit control was linked to the predominance of foreign trade in S.A. Since the intention and hope of English financial capital was to restore eventually the pre-war system, Strakosch's advocacy of a central bank suggests also a recognition that foreign trade, if still dominant, was no longer the only important feature of the S.A. economy. It was a recognition, in other words, of the beginnings of the shift to industry and the associated growing importance of national capital. The Bank of England's direct hand is discernible, in Strakosch's intervention. As already noted, Strakosch and Montagu Norman had a very close connection from the early 1920s and so quite possibly at this time too. Furthermore, a close advisor to Norman in the 1930s, involved in establishing central banks in the other Dominions, suggested that it was 'thanks to his, that is Norman's prompting, that South Africa had established a central bank 'By this means, [Norman] hoped to maintain British influence without visible "strings". His ability to do so was certainly enhanced by the appointment later in 1920 of W. Clegg, the South African-born Chief Accountant of the Bank of England,to be the Reserve Bank's first Governor. English financial capital's influence over S.A. monetary regulation could thus be maintained, despite the establishment of the Reserve Bank. ------------------------------------------------------- Call Randburg Coin Now (011) 789-2233 or (011) 789 -2234 KINDLY NOTE: Payment methods we accept on this promotion are - bank transfer or cash on collection |